Introduction

It appears that prevailing business culture in the banking profession has promoted dishonesty. A randomized trial involving employees at a large Swiss bank demonstrated that, on average, banking employees behaved honestly when they did not identified themselves as such; however, when put in a context where they identified themselves as members of the banking industry, a significant proportion of them behaved dishonestly.1 Such dishonest behaviours can induce bank customers to buy high risks financial products, leading them to unforeseen indebtedness, and even personal bankruptcy. The United States Financial Crisis Inquiry Commission concluded “Widespread failures in financial regulation and supervision proved devastating to the stability of the nation's financial markets…There was a systemic breakdown in accountability and ethics”.2 In Europe, banking deregulation has been identified as a main cause of the recent economic recession and of massive indebtedness.3

Quoting the International Organization of Securities Commission “Complex products were often sold to elderly and senior investors with little investing experience and market knowledge”.4 Financial frauds have caused loss of lifetime savings to millions of citizens, both small savers and those accepting abusive mortgages.2 Such financial frauds may have harmful consequences for the health of those affected, but little research has been conducted on these consequences.

We advance the hypothesis that fraudulent behaviours by financial institutions are associated with substantial physical and mental health problems in the affected populations. Data from a pilot study in Spain were used to assess health status of populations affected by financial frauds comparing with the health of the general populations to which they belong. We also examined the potential relationship between financial compensation obtained through legal processes and adverse physical and mental health outcomes and poor quality of life.

Context of the study

Spain has been strongly affected by the recent economic crisis caused by the behaviour of financial institutions. Many instances of financial fraud occurred during the period between 2007 and 2014.5-7 Spain was vulnerable to widespread fraudulent behaviours in the banking sector due to: 1) collusion between political power and board of directors of saving banks; 2) an exacerbation of the recession linked to the falling value of the real estate market caused by irresponsible lending.8 Many fraudulent behaviours were carried out by trusted financial advisors at local bank branches with whom small savers had long-standing trusting relations.

We will consider here two main forms of fraud. First, those that originated from the sale of complex products to consumers with the purpose of mobilizing the savings of potential small investors to rescue banks. This fraud is called preferentes in Spanish for preferred shares, hybrid products which are best defined as complex debt instruments according to the European Securities and Market Authority.9 The Spanish Parliamentary Commission appointed to investigate the commercialization of preferentes estimated that about 3 million small savers were affected in the period between from 1998 to 2012.10 This constitutes a sizeable proportion (8%) of the 37 million adults over 20 years of age in Spain (Census, 2010). A second type of fraud consisted in inducing clients to contract mortgages in a foreign currency (Japanese Yens or Swiss Francs), with the argument that the interest rate applicable to the currency in which the mortgage was denominated was lower than the interest rate applicable in euros, for example, 0.5% for loans in Swiss Franc loans instead of 5% for the Euribor. Banks did not inform clients on the forecasted instability of the euro with regard to the Japanese yen and Swiss franc. With decreasing exchange rates, mortgages labelled in these currencies could hit skylines values in euros, leading to indebtedness and capital loss in real terms. As an illustration, by September 2011, those who had contracted an average loan of 200,000 euros in 2008, had seen their mortgage increase to 280,000, even though monthly payments were hitting new highs without foreseeable end. An equivalent home loan in euros would imply equal monthly payments and a mortgage value reduced to 180,000 euros. This fraud is referred to as a foreign currency home loan or multidivisas in Spanish.

Methods

Design

This is a pilot study. Data was collected between July 2015 and July 2016 in meeting places located mostly in the province of Leon (city of Leon and county La Baneza) and the Madrid metropolitan region. Since the list of small investors involved in bank frauds is not available, we recruited volunteers through the members of associations of people whose savings were affected by financial frauds, following the principles of venue sampling for hard to reach populations.11 We asked volunteers who belong to associations of citizens affected by these frauds to recruit other people they know who share that condition, irrespective of the absolute amount of the fraud or of their membership in any association. Due to budgetary and time restrictions we included collaborators in Madrid and in Leon. For the preferentes group, participants were recruited at Madrid and Leon, but the study sample includes participants who resided in other provinces from the region of Castilla-Leon. For the multidivisas group, data was collected at the ASUFIN office (www.asufin.com) located in downtown Madrid and while most participants resided in Madrid, a few resided in cities of Andalucia and the Canary Islands. Most participants are from urban areas of more than 50,000 inhabitants.

External data base for comparison and age -adjustment

The 2011-2012 National Health Survey is accessible at the Spanish Ministery of Health web site.

Data collection

Data were collected by self-administered questionnaire. The questionnaire is available upon request. Most questions on sociodemographic variables, and health outcomes were drawn from the 2011-2012 National Health Survey to increase comparability. A section on financial frauds characteristics was added.

Outcomes

Psychological distress was measured by the General Health Questionnaire (GHQ-28), a psychiatric screening instrument composed of four subscales (somatic symptoms, anxiety and insomnia, social dysfunction and depression), each of seven items.12 Individuals with a GHQ-28 above or equal to 5 were considered as having clinically relevant symptoms indicative of need of mental health care.13 Self-reported diagnoses of psychiatric disease after 2008 and frequency of anxiety crises after 2008 were also recorded.

Resilience, the courage and adaptability in face of life misfortune, was assessed with the Wagnild and Young14 resilience scale, which is composed of 14 items in a scale from 1 to 7.14

Self-rated health is a valid indicator of health according to the general literature.15 Participants were asked: “Would rate your health as very good, good, fair, poor, or very poor?”. Self-rated health was considered good if respondents answered “very good” or “good”, and it was considered poor if respondents answered “fair”, “poor” or “very poor”.

Chronic conditions diagnosed after the year of the reported fraud (high blood pressure, diabetes, cancer, chronic lung disease, heart disease, stroke and rheumatic diseases) were self-reported based on the question “Has a doctor or nurse ever told you that you have…”. What was the year of that diagnoses?

Pain was assessed with one general question about being bothered by pain in the last month.16 Those who answered positively were asked to report where they had pain from a list of anatomic sites.

Sleep duration, efficiency and quality were obtained with the Pittsburgh Sleep Quality Scale,17validated for Spain.18

Quality of life was assessed with a visual analogue scale ranging from 1 to 10. Given our previous experience with this scale, a good quality of life was estimated at 8 out of 10 or above, which corresponds roughly to 75% of the older adults population.19,20

Measuring the exposure to frauds

For preferentes, four sections were included in the questionnaire: A) nature of the financial product: amount, amount as proportion of total savings, name of financial entity and date of the operation; B) date at which the person was made aware of the loss of savings; C) date at which the person started a legal claim, if any; D) date at which the person was financially compensated, if there was a compensation and by what amount. The chronicity of the exposure was calculated as the difference between the date the affected person was made aware of the loss and the date of compensation or the study interview date. For multidivisas, we computed the difference between the amount of the initial loan and the amount the person owes to the bank at the time of the interview. At the time of writing, only two of the subjects affected by these loans had reached an arrangement with their bank to change the currency of their loan from a foreign currency to euros; thus, we could not examine the effect of the reconversion of the home loan to euros.

Covariates

Age, sex, education, occupation, income and sufficiency of income to cover basic needs were considered potential confounders as they could be associated with health and loss of savings.

Statistical analyses

First, descriptive and bivariate statistics were used to compare the three exposure groups (preferred shares with financial compensation, preferred shares without compensation, and home loans in a foreign currency) using the Chi-squared test for categorical variables and the F-test for continuous variables following approximately normal distributions. Age-adjusted prevalence rates were computed using the total population of n = 188 participants as the standard population. Second, health outcomes were compared to similar indicators in comparable age populations participating in the 2011-2012 National Health Survey (NHS) which contains information on 18734 subjects aged between 29 and 92 years, the age range of participants in this pilot study. This subsample of the NHS was used to compute weighted age-adjusted prevalence for the pilot study health outcomes.

Results

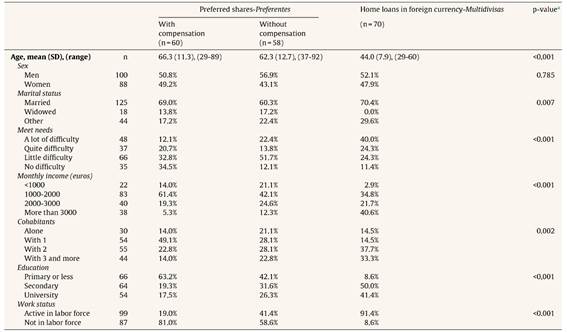

The final sample is composed of 188 respondents. Approximately 60% come from the Madrid recruiting sites and the remaining subjects come from the Leon recruiting sites. There are important demographic differences between the three comparison groups (Table 1). Those affected by preferentes are approximately 20 years older, less educated and have lower incomes than the multidivisa group, which are more active in the work force.

Table 1 Sociodemographic characteristics of the three study samples.

ap-value for F-test of means or for Chi-square test for equality of proportions.

In the preferentes group, the average amount lost was 60660 euros (range from 3000 to 300000). The proportion of total lifesavings lost reached more than 80% for 25% of participants and was less than 20% for 20% of participants. The time between the awareness of fraud and receiving compensation was 2.4 (SD=1.4) years for the 60 people who had received compensation for their loss of savings; among the 47 people who were still waiting for financial compensation, this time was on average 4.4 years (SD=1.8). Eleven subjects had not started legal procedures. Among the 70 subjects in the multidivisa group, only two had achieved reconversion of their loan to euros.

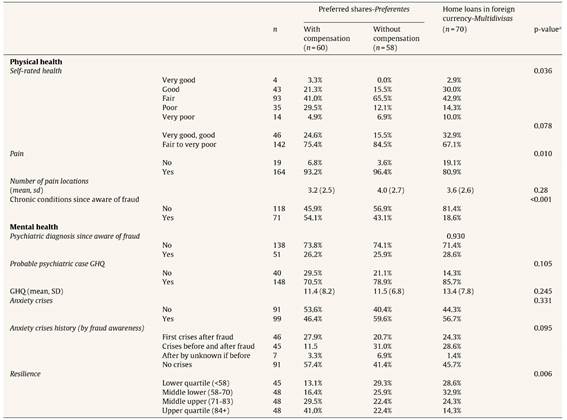

Two thirds (67%) of those in the multidivisa group declared having poor health, compared to three fourths (75%) for those who acquired preferentes and were compensated, and to 85% among those with preferentes without compensation (Table 2). The age-standardized prevalence for poor health was 67% (95%CI: 48-87) for multidivisas, 56% (95%CI: 40-73) for those with preferentes who were compensated and 84% (95%CI: 61-108) for those with preferentes without financial compensation.

Table 2 Physical and mental health status indicators in the three study samples.

ap-value for Chi-square test for equality of proportions or p-value for F test for equality of means.

Pain was reported by almost all of those in the preferentes groups, and four out of five of the multidivisa sample reported some chronic pain. The number of anatomic sites with pain was similar in the multidivisa and in the preferentes groups. The two sites that were reported most often in the preferentes group are legs and hands, possibly related to the high frequency of arthritis in older populations. Headaches were significantly more frequent among the multidivisa sample, which may reflect stress headaches. About half of the preferentes group had been diagnosed with at least one new chronic condition after awareness of the fraud with no significant difference according to compensation; the corresponding figure for the multidivisa group was 19% (Table 2). Age-standardization prevalences of chronic pain and chronic diseases were similar to these observed proportions.

One fourth of the participants had received a diagnosis of psychiatric disease since being aware of the fraud and more than 75% of each group obtained scores compatible with a psychiatric disease in the GHQ (Table 2). More than half of participants had ever experienced anxiety crises; about half of them had a history of anxiety crises before the fraud and have continued to have them thereafter, while the other half experienced their first crisis after becoming aware of the fraud. All groups showed similarly high levels of anxiety and need for psychiatric care. Standardization changes very little the observed proportions. For example, the age standardized rates of psychiatric disease by GHQ are 82% (95%CI: 61-100) for multidivisas, 77% (95%CI: 55-100) for preferentes without compensation and 69% (95%CI: 48-90) for preferentes with compensation compared with the original corresponding estimates of 86%, 79% and 70%.

Resilience, as assessed at the time of the interview, was significantly lower among those who had no compensation and the multidivisas group compared with the preferentes group with compensation (Table 2). The age adjusted percentage of low resilience was 31% (95%CI: 16-46) among the preferentes without compensation and 26% (95%CI: 15-37) among the multidivisas compared with 10% (95%CI: 3-17) among the preferentes group with compensation.

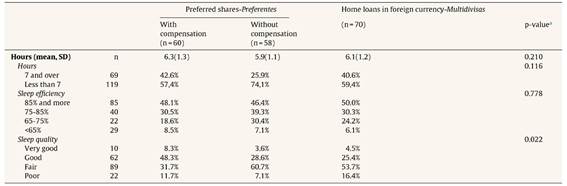

The average number of hours of sleep was six without significant differences across groups. Half of respondents reported very good sleep efficiency with no differences across groups (Table 3). We found a difference in the quality of sleep according to compensation status. More than half of those with compensation reported having good or very good quality of sleep, while this percentage is significantly lower among those without compensation and in the multidivisas group (Table 3). The age-adjusted proportion with poor quality of sleep was 45% (95%CI: 28-63) for those in the preferentes group with compensation compared with 69% (95%CI: 47-91) among those without compensation and 73% (95%CI: 52-94) in the multidivisas group.

Table 3 Sleep characteristics in the study samples.

ap-value for Chi-square test for equality of proportions.

The average proportion reporting a poor quality of life was significantly lower in the preferentes group that had received compensation (64%) compared with those without compensation (84.2%) and those in the multidivisas group (84.9%) (p=0.027 for equality of proportions). Changes in these proportions after age-adjustment were negligible.

Comparison with population health surveys (Table 4)

Self-perceived health was poor among populations affected by financial frauds and stands in sharp contrast with the Spanish National Health Survey results. Only 32% of the 2011-2102 NHS population with ages between 29 and 92 reported poor health, the corresponding age-adjusted figures were 47% for those in the preferentes group with financial compensation, 63% for those with compensation and 66% for those in the multidivisas group.

Suspected mental illness according to the GHQ was much higher in all comparisons groups than in National Health surveys estimates: the prevalence was 21.8% in the NHS population compared with 73% (preferentes with compensation), 77% (preferentes without compensation) and 84% (multidivisas).

The prevalence of having ever received a psychiatric diagnosis of depression or anxiety was 12.1% in the NHS population compared with the age adjusted prevalences of these diagnoses after the fraud of 25% (preferentes with compensation), 31% (preferentes without compensation) and 29% (multidivisas).

The proportion sleeping less than 7hours was 24.8% in the 2011 NHS compared with the age-adjusted proportions of 55% (preferentes with compensation), 78% (preferentes without compensation) and 65% (multidivisas).

The three groups rated their quality of life as poor compared with general population reports.19-21

Discussion

This pilot study suggests that those affected by financial frauds have poorer health than the reference general population participating in the 2011-2012 national health survey of Spain. Results of this pilot study support the hypothesis that victims of frauds have suffered damage to their physical and mental health, to their sleep and quality of their life. In spite of the different age distribution, the people affected by multidivisa loans were not very different from those affected by the preferentes fraud in most of the health and quality of life indicators considered. The preferentes respondents who had received financial compensation had overall better health and better quality of life than those without compensation. The gap between diagnosed psychiatric illness and suspected psychiatric illness based on GHQ scores suggests considerable underdiagnoses of mental problems. Our results provide preliminary evidence of the harmful effects of financial fraud for the health of fraud victims.

Mechanisms

Considering the literature on relationships between economic strain and social stress and health, three major mechanisms could explain the effects of financial frauds on health.22-25First, loss of money and property may lead to chronic financial stress or indebtedness. Populations affected by preferentes have suffered the partial or total loss of life savings, while populations affected by multidivisa are actually indebted for unpredictable amounts. Financial strain and material deprivation are well known risk factors for poorer health throughout the life course.26,27 Second, experiencing the abuse of trust may lead to feelings of shame, guilt and family conflict, all of them potent risk factors for mental health. Poor health behaviours would constitute the third mechanisms. Material deprivation as a consequence of financial fraud can have both a direct effect on health, and an indirect effect via psychosocial factors and the adoption of unhealthy coping behaviours. Lastly, reverse causality may be a partial explanation since people with poor physical health or mental and cognitive disorders may be more likely to be taken advantage of. In addition, the fraud-health associations in Table 4 may be underestimated since the NHS survey population that we use as comparison may contain fraud victims and this will result in higher prevalence of poor health outcomes.

Table 4 Weighted age adjusted prevalence (95% confidence interval) of health outcomes.

| Preferentes with compensation | Preferentes without compensation | Multidivisas | 2011-2012 NHS | |

|---|---|---|---|---|

| Age in years (range) | (29-89) | (37-92) | (29-60) | (29-92) |

| Fair, poor, very poor self-rated health | 54% (37%-72%) | 85% (74%-97%) | 66% (54%-79%) | 32% |

| Psychological distress, GHQ12 | 75% (62%-89%) | 80% (66%-94%) | 77% (64%-89%) | 22% |

| Diagnoses of psychiatric diseases (ever in NHS and after awareness of the fraud in this pilot) | 26% (7%-45%) | 30% (14%-46%) | 27% (14%-40%) | 12% |

| Less than 7hours (%) | 57% (36%-79%) | 78% (65%-91%) | 68% (56%-81%) | 25% |

Testing these hypotheses would require a longitudinal population study with a large enough sample of individuals willing to provide biological samples and sensitive personal information and to be followed-up during several years. That research would need substantial economic support during an extended period of time.

Strengths and limitations

The main limitation of this study is the voluntary nature of participation. At this point, we are unable to assess if those who volunteer to participate are more or less affected than those who decided not to participate. Two interpretations are possible. First, if the most affected population was less likely to participate, our findings would underrepresent the burden of financial frauds on population health. Second, if the population not involved in associations of citizens affected by frauds is less likely to suffer severe frauds or related health consequences, our recruitment strategy would lead to an overestimation of the average effects of frauds on health. A second limitation is the small sample size since due to budgetary constraints we restricted field research to one year. The small sample size hinders our ability to examine dose-response relationships. We attempted to assess categories of duration of exposure by the time of exposure to stress; we used the years between been aware of the fraud and interview time for those who have not received compensation, or the number of years waiting after a claim was filed and until the case was resolved for those who had a compensation, but there was lack of statistical power using such small groups. This design and restricted sample do not allow to examine the moderating effects of social support and resilience on the associations between fraud and health and the mediating mechanisms outlined above. Lastly, non-differential misclassification bias could affect the comparison of the study samples with the NHS participants if the experience of fraud had affected self-reports of health outcomes. Among the strengths, we would like to mention the originality of the study and the validity and extended use of the health measurement tools, which enhance the comparability of results with the general population.

Future research

Research on the relationship between financial frauds and population health will promote the recognition of this serious public health issue and provide evidence to develop appropriate compensation for affected individuals and their families through dedicated social programmes. Questions about financial frauds should be included in general health surveys. Research could provide evidence to support legal restitution and financial compensation. Qualitative research could also further investigate the mechanisms through which the experience of financial fraud manifests across families and groups.

Conclusion

Our research suggests financial fraud harms health and quality of life. A dedicated research program on the relationship between health and financial frauds is thus needed in order to provide evidence that may help recognizing this issue and ultimately benefit the affected populations. If the results of this research are confirmed in larger population studies, interventions providing healthcare and legal assistance should be implemented, in addition to financial compensation.