My SciELO

Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Anales de Psicología

On-line version ISSN 1695-2294Print version ISSN 0212-9728

Anal. Psicol. vol.29 n.2 Murcia May. 2013

https://dx.doi.org/10.6018/analesps.29.2.150621

The narrow range of perceived predation - a 19 group study

El intervalo estrecho de la depredación percibida - una investigación con 19 grupos

Olivier Mesly and Jean-Pierre Lévy Mangin

University of Québec in Outaouais

RESUMEN

Este artículo se ciñe en las investigaciones de Mesly (1999 a 2012) y presenta los límites de conducta funcional de la percepción percibida en un estudio de 19 grupos distintos repartidos en un periodo de cuatro años. La constante k =1.3 identifica el carácter invariable de la depredación percibida. Los resultados se asemejan a los de la teoría del apego y de la depredación financiera estipulando que los depredadores financieros actúan por debajo de los límites de detección de los clientes y de las agencias de control de los mercados, por ello se vuelven expertos en reducir a la mínima expresión la percepción de los clientes causándoles un daño financiero serio.

Palabras clave: Depredación percibida; el modelo Mesly; la teoría del apego; la confianza; la cooperación; el depredador; la presa.

ABSTRACT

This paper rests largely on the works of Mesly (1999 to 2012). It argues that the phenomenon of perceived predation as a functional behavioural phenomenon is subjected to certain limits, a finding based on studies performed on 19 different groups spread over a four-year span. It also finds a constant of k = 1.3 which reflects the invariant nature of perceived predation. These findings add to the theory of financial predation which stipulates that financial predators operate below the limits of detection pertaining to their customers (and market regulators). They are experts at minimizing the perception that clients could have that they are after their money, causing them financial harm, by surprise (perceived predation). Understanding the narrow range in which financial predators operate is setting the grounds to offer better protection to investors and to implementing better control and punitive measures.

Key words: Perceived predation; MESLY model; attachment theory; trust, cooperation; predator; prey.

Introduction

There is barely a week going by without a newspaper article or a news channel announcing that somewhere around the globe a financial advisor or guru has got away with his clients hard-earned money. In Canada, it is estimated that nearly 5 % of the population has lost money to "some kind of investment fraud or another" (Kempa, 2010, p. 252). The question is how do those financiers manage to escape the radars institutionally set by financial regulatory agencies such as Security Exchange Commission (SEC) and intuitively by common investors1?

We argue that financial predators have a profound knowledge, if not an unconscious knowledge, of predatory mechanisms. Understanding these mechanisms amounts to unveiling the modus operandi of financial crooks. This paper rests largely on the theory of predation as set forth by the works of Mesly, Mesly and Levy Mangin, and Mesly, Levy Mangin and Racicot (1999 to 2012) and thus has deliberately chosen to resort only to the most significant literature in the context of the present study. Important articles have in the past follow this procedure with much success. This paper consists of an analysis of data collected over a four-year span, in various economic and non-economic contexts, using the same measurement and analytical method (so-called data percolation-Mesly 2012a) and essentially the same tools. Since results corroborate previous results found by different scientific authors (e.g. Anderson and Nanus, 1990), we feel the measurement and tools used are appropriate and that the present research has strong nomological value2.

The main finding with respect to the present paper is that perceived predation operates within certain set boundaries. From there, we are able to develop a simple mathematical function that attempts to disclose the mechanic used by financial predators tojure their preys.

The concept of financial predation

Financial predation refers to the phenomenon whereby some financial experts operate in systematic ways in order to bait their victims, abuse and rob them while being able to protect themselves from the claws of justice.

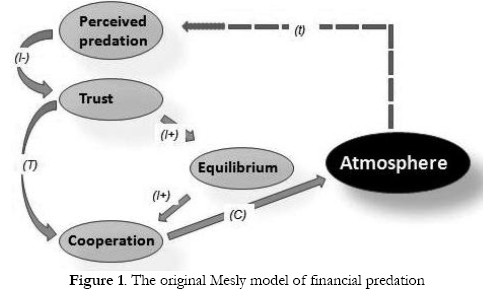

The theory of financial predation is based on the following model (Figure 1), which has been tested across the 19 groups used in this study and in two longitudinal studies by Mesly (2010 to 2012).

In essence, this is how Figure 1 reads. A customer can start with a negative perception of his financial advisor or else, he may end up having a negative perception of same (perceived predation therefore assumes the role of either an explanatory or an explained variable). Perceived predation is the fear that a customer (in this case) has that his financial advisor may have insidious objectives, such as stealing his money. Predation is the act of abusing someone's vulnerability; trust is the acceptance of putting oneself in a position of vulnerability with the expectations or belief that the other party wants one good, not bad (Mayer, Davis and Schoorman, 1995)-this positive outlook serves the inherent need to attachment towards others (Bowlby, 1973). Hence, perceived predation negatively influences trust (I-) on the basis of vulnerability3.The exact mathematical function tying these concepts will be explained further below.

Trust develops over time; there can be cooperation without trust (e.g. one is forced to cooperate with a colleague without ever trusting him) but sound cooperative efforts emerge as trust develops over time (T). The Pearson coefficient (R2) between trust and cooperation will be discussed below.

A sense of positive equilibrium4 (of win-win) serves as a mediating variable between trust and cooperation (I+, I+). Baron and Kenny (1986)'s test for assessing mediating variables will be discussed below.

Cooperation causes the general dyadic atmosphere (C) between the financier and his client to be overall positive. Negative cooperation will necessarily lead to negative atmosphere5.

A positive atmosphere will likely help, with time (loop action t), to reduce perceived predation or create it altogether (if the atmosphere turns negative), in which case the client will become defensive prior to meeting with his financial advisor. Structural equation modeling (SEM) pointing to these relationships between the key variables are discussed below.

Trust is considered to be formed of four so-called structural variables6: affinity (AF), benevolence (BV), ability (HB) and integrity (IN). Cooperation is considered to be reflected by four functional variables: flexibility (FL), exchange of information (EI), joint problem resolution (RC) and orientation (OR). Altogether, these eight variables will be used in a SEM analysis further down in this paper to infer on the latent variables of trust and cooperation7.

Previous researches by Mesly (2012b, c) have discussed the fact that financial predators have unique features (they operate in well-known territory, aim for the helm of the ecosystem in which they belong to and target the assets of their preys, as opposed to their activities or mobility). They also share common traits: they are cold, selfish, calculative and sneaky. They operate much like criminals, having mobile (money) and weapons (asymmetry of information and the use of complexity in particular). They often build their reputation on their ability to overcome obstacles, such as market trends. The strategy used by financial predators is best represented by the financial web, as follows (Figure 2):

In essence, financial predators identify their preys' strengths and weaknesses (such as a tendency to trust blindly) and they bait them with, as examples, a shiny corporate image, their undamaged reputation or else by making their clients believe they are part of a selective few. They tactfully force decision upon their clients, for example by putting time pressure and providing incomplete information. They trap them, for example by putting in place exit strategies that seem costly to their clients (e.g. an exit fee). Finally, they subdue their preys with contracts and complex illusions of future returns and the likes.

The concept of perceived predation

Perceived predation is to human relations what perceived risk is to the relation customer-product. Humans are anthropologically and from a neurobiological point of view8 set to detect possible sources of danger. Once detection has been effectuated, they engage in a protective set of actions, which can be defensive or aggressive in nature. First, they create representation of the threat (which can be external or internal-e.g. a virus); they then (2) put themselves in a certain disposition (rise in corticosteroid and adrenalin for example, or inversely, rise in oxytocin levels indicating a higher sense of trust); (3) they evaluate the benefits and costs of their possible actions (in nature, for example, deciding between foraging or escaping an approaching predator); fourth (4) they engage in a certain action (such as fight or fight); and fifth (5), they conclude (for example, some animals will show submission much like an unhappy customer will stick to an obviously-abusive financial expert based on the fear of engaging in more relational difficulties).

Perceived predation can be measured using these five functional steps9. As it turns out, the measurement of perceived predation, that is, of the perception that an individual has that another individual wants to cause him harm (e.g. financial loss) by surprise, seems to be an excellent indicator of various emotions (such as anger). Generally speaking, the actual act of predation is preceded by frustration, provocation, and aggression, which all entail specific emotions such as disappointment and, hostility). Our mathematical function will address this in more details further along in this paper.

It is not the actual act of predation that matters in the theory of financial predation but the perception the client (to take this case) has of his financial advisor. The latter may actually be an honest broker but it is enough for the client to believe otherwise to change the quality of dyadic interactions.

An expert financial predator has become skilful in the art of reducing perceived predation by setting up rituals (e.g. an annual meeting) that confound his preys and in generating blind trust.

For the sake of this study, we will replace the notion of emotions with that of perceived predation, with the two having two commonalities: 1) first, they both entail a cognitive appreciation of events faced by the prey; and 2) they both find a biological expression (e.g. rise in heart beat).

Method: The study

Our study of perceived predation was conducted from years 2008 to 2012. It involved 19 groups ranging in number of participants from 13 to 184. These groups were randomly chosen and belonged to different spheres of human activity, in particular: banking, real estate transactions, car sales, orchestra and choir settings, and classes of university students. Over 500 participants were actually met in person and single or multiple semi-directed interviews as well as focus groups were conducted (see Mesly 2010 in particular).

The population of each group is as follows (Table 1).

Participants were asked to answer the MESLY questionnaire®, in which, of course, the words predation, predator and prey are never mentioned; neither are the words trust nor cooperation. All these variables were treated as latent variables when analyzing their structural and functional variables.

Perceived predation is measured as follows:

Prey (weaknesses) / Predator (strengths)

(equation 1)

In other words, perceived predation is a measure of the feeling a participant has that he is exposing more weaknesses than strengths, thus showing his vulnerabilities to a potential financial predator.

The use of the equation has been found difficult to handle in real life discussions, so that most often, the reverse function (a proxy for self-confidence) is used, as follows:

Predator (strengths) / Prey (weaknesses)

(equation 2)

In this case, people relate much better to the concept. Predator/prey measures the capacity the respondent feels he has in exercising his own strengths despite his weaknesses. In other words, it is a measure of his ability to defend himself. If he feels the financial expert is a predator, he then perceives himself as a potential prey, the reverse being true. Generally speaking, in most normal circumstances, equation 2 (self-confidence) is above the value of 1 and thus easy to grasp, because people are more eager to see themselves as self-confident than as victims. When it is below the value of 1, the respondent (or investor) feels he is a victim (a prey), which generally people will try to hide. In fact, below the value of 1, we found the relationship deteriorates, temporarily ruptures or end altogether (Mesly, 2010).

The present paper is about analyzing this simple function (equation 2). As will be seen in the next section, it reveals a tremendous amount of information about human interactions.

Results

To fully apprehend the notion of perceived predation, we proceed as follows. First, we look at the bond between trust and cooperation with a single linear regression analysis (which will be looked at10 also with Pearson coefficient R2). Second, we verify that equilibrium is indeed a partial mediating variable, using Baron and Kenny 1986's procedure. Thirdly, we run a SEM on the left part of the Mesly model (Figure 1: perceived predation, trust, equilibrium and cooperation), which corroborates the fit of the model. Fourth, we run a factorial analysis, which underscores the so-called law of perceived predation (Mesly, 2010). Fifth, we run a series of perceptual maps to exemplify the fact that perceived predation is active under certain minimum and maximum thresholds and to identify its linear nature.

We then proceed (six) with a cluster analysis that shows that our data fits the traditional typology found in the attachment theory, completed by a two-axis diagram based on ethology (dominant-dominated; aversion-seduction). Finally, we conclude by reviewing our main findings and pointing out the limits of our researches.

Bond between trust and cooperation-single linear regression

For every single one of the 19 groups studied, that bond was statistically confirmed11 (see Table 2).

• Observation 1: The lowest R2 is .471; the highest is R2 = .877; all groups combined = .779.

• Observation 2: the resulting OLS shape is an elliptic one, so that the data seems well spread along the regression line.

• Observation 3: Most "events" occur in the upper right corner, that is, when levels of trust and cooperation are above 312 (or, put differently, above 40%). It is to be remembered that in all of these cases, perceived predation is under control13. That is, we can interpret this by assuming that when perceived predation is at an acceptable level (not too strong, not too weak), people in a dyad will trust and cooperate at least 60% of the time (100% -40%), if not more14.

• Observation 4: These results corroborate past researches (Anderson and Narus 1990's estimator is at .73; Palmatier et al., 2006)

We feel that it is fair to conclude that trust is strongly correlated with cooperation in the sense that trust positively influences cooperation (I+), in a linear fashion. The more trust, the more cooperation. Most people seem to have a predisposition to trust and hence to cooperate without overly compromising themselves. It seems that in any given circumstances:

Cooperation = α + β1 Trust + ε

(equation 3)

Working out the averages of alphas (α) and betas (β), we arrive at the following measurement (rounded up numbers):

Cooperation = .3 + .9 Trust + ε

(equation 4)

This means that the level of cooperation is explained by an initial endowment (alpha α, which probably reflects the fact that most people have a certain amount of positive predisposition towards others to start with15, at a level that is not overly compromising), the amount of trust granted to the other person (beta β, which is almost equal to 1) and an error term (epsilon ε). Since trust is directly affected by perceived predation, we can assume that any changes in cooperation can find some indirect origin in perceived predation. In practical term, the financial crook who wishes to gain trust and ensure collaborative efforts from his clients will do all he can to minimize the effect of perceived predation. He also knows he can bet on an inherent predisposition to trust and cooperate (most people will invest at least 30% of their resources, such as time, to engage in an interaction with someone else) and on a tendency for people, under normal circumstances, to participate substantially in the construction of the interaction between him and his client (at least 60% of the time, most often much more).

Equipped with such a conscious or unconscious understanding of those human traits, the financial predator will start building his web to catch his preys, causing them harm, by surprise.

Equilibrium as a mediating variable

An investor wishes to enter into a business relationship with his financial advisor on the assumption that both have something to gain and hopefully nothing to lose. It would not make sense for either party in this dyadic encounter to opt for losses. However, the client is most likely motivated by two conditions: first, he would want to improve his condition (his financial wealth) as long as that of his advisor is not negatively affected; that is, he would target a Pareto optimum. An advisor who would end up losing time and money trying to invest on behalf of his clients would probably take hasty decisions or cut the relationship. Second, the client is interested in continuously improving his own condition, providing that any improvement will not come in the end to the detriment of his current position; that is, he wants to maximize his benefits and minimize his costs knowing that at the same time, his financial advisor wants to maximize his own benefits and minimize his own costs. This is tantamount to Cournot-Nash equilibrium.

All in all, the relationship between the client and his advisor can continue regardless of any maximization attained in the Pareto or Cournot-Nash positions, but it is obviously more advantageous to work together towards a win-win situation. Hence, equilibrium (or a sense of win-win-reciprocity, equity), may not be essential at all times but is certainly helpful16. It is a mediating variable.

To test the mediation, we used Baron and Kenny's 1986 method and found that in most cases where the method was justifiably applied, equilibrium was indeed found to be a partial mediator. The following table shows how, in the case of the database of 834 participants, trust is affected (a decrease in the value of its beta β) by the introduction of the equilibrium variable (Table 3), after checking for the normality of populations, residuals and colinearity17:

• Observation 5: The beta β coefficient for trust has decreased with the introduction of the variable equilibrium, indicating that the latter plays a role, that of a partial mediator.

The consequence of this finding on the behaviour of the financial advisor is that it appears to be in his best interest to promote a sense of interactional balance. Most particularly, he will want to convince his client that both have to win by working together and that one cannot improve one's position without the other one also benefiting. Such articulated statement would give the client the impression of invulnerability. As an example, Bernard Madoff posted superior returns to whatever the market was doing year after year: he had built a reputation for being invulnerable.

SEM and estimators for model fit

A Structural Equation Modeling (SEM) was run with the available data; it produced the following result (Figure 3).

• Observation 6: The SEM is remarkably consistent with previous findings (Mesly, 2011, 2012). The estimators for the explanatory variables of latent variables of trust (HB= ability; IN = integrity) and cooperation (FL= flexibility; EI= exchange of information; OR= orientation) are quasi equal except for OR.

• Observation 7: the estimator value of .85 is the strongest found compared to literature in previous findings (see above-mentioned references).

• Observation 8: Perceived predation plays a key role in the dynamic between trust and cooperation, by negatively influencing trust.

• Observation 9: The resulting model (Figure 3) shows excellent FI and GFI indices, tending to confirm the MESLY model.

• Observation 10: all relationships are found to be significant at p=.0519.

Factorial analysis on predator and prey

When we ran a factorial analysis using Varimax rotation, we essentially produced the same results with every single of the 19 groups, as follows (Table 6):

• Observation 11: This Table 5 confirms the law of perceived predation. Every time predator > prey, this means the client is self-confident. He tends to trust, cooperate and judges the relationship to be fair. As soon as predator < prey, the client feels he is a victim, and his levels of trust, cooperation and his perception of win-win tend towards zero (0).

This means that the more intense perceived predation is, that is, the more the client perceives the financial advisor as a potential threat (someone who wants to take advantage of his money in order to serve his own interests, by surprise), the less likely this client will trust the advisor, cooperate with him (e.g. accepting to do a certain number of transactions), and the less likely he is to believe in a fair relationship. Because the sense of win-win is measured by an evaluation of one's own position towards others (Pareto efficiency) and towards oneself (Cournot-Nash), perceived predation will likely put the client on the defensive, freeze him or entice him to leave the relationship. This is, of course, the last thing the financial predator wishes. It is in the best interest of the financial predator to use as many subterfuges as possible to hide his real identity in order to reduce the amount of perceived predation in the eyes of his clients. He necessarily achieves this through information asymmetry, the use of complexity (to baffle the client and regulatory agencies alike) as well as disinformation (use of incomplete, untrue or irrelevant information), as financial predation is precisely based on information.

Put simply, minimizing perceived predation is one way of locking the client into the predatory financial web and of avoiding the risk that the client runs away. We can tentatively posit that:

Cooperation = .3 + .9 Trust + ε/ given (Predatory > Prey) for at least 60% of the time

(equation 5)

Perceptual maps on perceived predation vs. AF, BV, HB, IN and FL, EI, RC, OR

Perceived predation has so far proven to be a key component of the relationship between dyadic parties. A further understanding of it can come by trying to delimit its acceptable range; as seen above, the relationship between trust and cooperation is conditional to perceived predation being within acceptable limits, that is, to being manageable. To identify these limits, we decided to produce perceptual maps for every single explanatory (structural) variable of trust and every single (functional) variable of cooperation found to be significant through our SEM effort.

For trust, the results are as follows (Table 7):

There are a number of meaningful observations with respect to Table 6.

• Observation 12: First, most of the "events" occur in a band for both predator/prey (the reverse of perceived predation) and each of the structural variables that form the construct of trust.

• Observation 13: The band is systematically the same for self-confidence (or for the reverse, perceived predation), ranging from roughly slightly over 1 at a minimum, to a maximum 1.80. This band is the tolerance zone people are prepared to accept to keep the relationship functional. Table 8 further down gives the exact values of predator/prey ratio for each of the 19 groups. On average, the ideal ratio is that of 3.5 over 2.5 = 1.4 or, put in perceived predation terms, of 2.5/3.5 ≈ .7021. This means that perceived predation is invariant in terms of value22. Thus, our equation 5 can be temporarily revisited as follows:

Cooperation = .3 + .9 Trust + ε

/ given (1.80 >Predatory/ Prey > 1.00) for at least 60% of the time

Or:

/ given (.55 < Perceived Predation < .99 for at least 60% of the time

(equation 6)

• Observation 14: the tolerance zone varies, however, for the constructs of affinity (2 to 7), benevolence and ability (each 3 to 7) and integrity (4 to 7). This means that people are more accommodating in terms of how their financial advisor dresses (as an example of affinity) compared to their evaluation of his integrity. There is a 30% reduction in the band (from 2 to 7, to 4 to 7) between affinity and integrity: in the context of financial predation, it could be said that it is a whole lot more important for the client to deem the financial advisor honest than to evaluate whether they share the same tastes. This highlights the fact that it is in the best interest of financial advisors to at least appear honest.

Of note, the relationship established within the tolerance zone is usually stable23.

• Observation 15: there seems to be four different zones of behaviours. First, there is the average one, within the tolerance zone. Second there is one above it: here, people are overly predator, that is, overly self-confident (which means they themselves are probably perceived as intrusive), probably because they have a high (perhaps blind) appreciation of the AF, BV, HB and IN of the vis-à-vis (in our case), of the financier. These people are likely to be hostile (see further below). Third, there are the "events" left of the tolerance zone: these people lack self-confidence; they are or believe to be true victims and show little appreciation of their vis-à-vis. These people are likely to be evading (fleeing response): why stay in a relationship that brings little except worries?

The last group is below the entire spectrum from 1 to 724 which includes the tolerance zone, to the right. These people vary widely in behaviour, considering themselves potential victims (predator hardly higher than prey) and not knowing how to evaluate their vis-à-vis (their evaluation spreads from 1 to 7). That is, these people are likely to be anxious.

For the time being, these are assumptions but further analyses will tend to confirm them. All in all, trust, which is formed by the structural variables of AF, BV, HB and IN, is found to be within a tolerance zone while perceived predation is found to be invariant. Graphically, we can summarize as follows (Figure 3).

Obviously, the financial crook does not want to only minimize perceived predation, he also wishes to increase self-confidence in the eyes of the client; he wants to make him feel worth something. A salesmanship always works along these two directions: with reference to products, a salesperson wants to reduce perceived risk (for example, by offering a warranty) and endeavours to increase perceived value (value customers grant the product they long)25 in the eyes of his client.

For cooperation, the results are as follows (Table 8):

A number of observations can be made with respect to the above findings.

• Observation 16: As with the case of trust, two variables have a medium spectrum (FL and RC: 3 to 7), one has a wider spectrum (2 to 7 for OR), and one has a narrower spectrum (4 to 7 for EI). This means that the respondents are less tolerant when it comes to exchanging information than for feeling their vis-à-vis is keenly interested in them (OR).

• Observation 17: As was the case with trust, it is an emotional variable27 that has the wider spectrum (2 to 7 for AF in the case of trust, and 2 to 7 for OR in the case of cooperation).

• Observation 18: As was the case for trust, it is a cognitive variable that has the narrower spectrum, and thus, that has more importance in the eyes of the beholder (IN for trust, EI for cooperation).

• Observation 19: the same upper and lower values are found for perceived predation (or its reverse, self-confidence), pointing towards invariance of this construct.

If we were to summarize our findings, we would obtain the following noteworthy table (Table 9).

Clearly, where people are more sensitive is with respect to integrity and exchange of information (two cognitive variables), which most probably work hand in hand. Thus, it is around his image as an honest person and based on information exchange that the financial predator is likely to build his predatory web. It is most likely that he baits his victims by betting on these two dimensions of trust and cooperation. All in all, people will however remain stable with respect to their sensitivity to perceived predation28.

Conclusion

Our analysis points to the fact that investors are not necessarily aware of what they engage into when they decide to trust a financial advisor. They seem to be naive in many cases (perhaps anxious) and to seek the maximization of the utility of their money regardless of cues that could help them identify financial predators.

Financial predators are street smart in the sense that they somehow understand the law of perceived predation; hence, they'll do all they can to position themselves within the good atmosphere zone while nurturing selfish motivations. The law of perceived predation states that the more a person feels self-confident, or put differently, the less perceived predation this person experiences, the more likely he is willing to trust the financial advisor and to cooperate with him, for example by establishing a strategy for investing money in the market place. Financial predators are likely to bet on their image of integrity and on giving the impression that they share valid, complete and true information29.

We have seen that perceived predation seems to be an invariant: it remains equal to itself across groups and across years. It could possibly be a proxy for the image of self. By way of the above demonstration, we have shown the mathematical link that exists between perceived predation, trust and cooperation.

Previous qualitative studies (see Mesly 2010) argue in favour of the findings expressed in the current paper. We have found that trust and cooperation obey a certain regression line and have confirmed the value of estimators and R2 found in past literature.

Overall, the present paper seems to offer various opportunities for future investigations into the realm of perceived predation. We believe it is one of very few studies in behavioural finance to have spread over such a long period of time (five years) with such a novel concept as that of perceived predation30.

1 A recent study shows that as far as fraud detection is concerned, it is not the financial regulators that do the best job, but rather employees (13% of cases), non-financial market regulators (13%) and the media such as the New York Times, the Wall Street Journal or Business Week (13%), with SEC at about 7% (see Dyck, Morse and Zingales, 2010). Most whistle-blowers employees end up being terminated, forced to quit or demoted.

2 If our results were substantially different from previous researches, we could question the validity and pertinence of our measurement tools; however, it is not the case. Our results fall in line with previous research that have used vastly different tools such as quantitative questionnaires and in-depth interviews.

3 In animal studies, research has shown that stress caused by the presence of predators tend to diminish the ability of rats to cooperate; hence perceived predation is assumed to have an effect (an indirect one) on cooperation (Rosebloom et al., 2007)

4 In our terminology, equilibrium is achieved by a win-win situation or a stand-off of equal forces.

5 We assume a pure causality effect similar to water in a pot put on a hot stove in a certain atmospheric pressure will inevitably boil.

6 Using the data percolation terminology (Mesly 2011, 2012a).

7 In this paper, we only conduct SEM analyses on the left portion of the Mesly model, that is: perceived predation (PP), the four structural variables of trust and the four functional variable of cooperation.

8 The hypothalamus, a cerebral component common to all mammals, is at the centre of predatory activity.

9 Using data percolation methodology, at least three observables must be identified and measured.

10 Given normality of residuals and populations.

11 All of our analyses use a 95% confidence level; p < .05.

12 A 7-point Likert scale is used in the Mesly questionnaire®. The value 3 thus corresponds roughly to 3/7 ≈ 40%.

13 This will be discussed further below.

14 Suppose they interact for an hour, 60% of that hour or 36 minutes would be dedicated to a sound negotiating atmosphere.

15 This initial capital of goodwill may be linked to a trust antecedent (built, for example, through the financial advisor's reputation or that of his firm). We conducted a longitudinal study in this sense and found that previous trust was an explanatory variable along current trust in determining the level in current dyadic atmosphere (see Mesly et al. 2012d). The estimator value of past trust on current trust was of 0.57, with current trust influencing cooperation, and cooperation being strongly correlated to current atmosphere.

16 Ultimately, all life rests on the capacity of living creatures to maintain homeostasis, that is, internal equilibrium, even if at times internal balance can be thrown off by internal or external events (e.g. hunger or bitter cold).

17 These data can be made available upon request.

18 Using the arrow system pertaining to SEM.

19 All data not specifically addressed in this paper are available upon request.

20 These maps are not read as the explanatory variable (e.g. affinity) explaining the ration pre-pro, but rather as a correlation between say affinity and pre-pro.

21 The absolute value (e.g. 2.5, 3.5) also has its relevance. This will be discussed further in the article.

22 Gottman (1993, p. 13), who uses a predator-prey model, also identifies an invariant in his ratio of positive to negative speaker codes within couples' dynamic. He notes that "Negativity appears to be dysfunctional only when it is not balanced with about five times the positivity..." (p. 14).

23 A fact corroborated by the researcher's follow-up on the groups and the verbatim resulting from meeting participants in semi-directed interviews (Mesly, 2010).

24 Remembering this refers to the 7-pomt Likert scale, with 1 being "do not agree at all" and 7 being "completely agree".

25 Perceived risk and perceived value are two fundamental concepts of marketing theory.

26 Again, these maps or not of influence with, for example, OR influencing pre_pro, but of correlation, with OR showing some correlation to pre_pro.

27 These variables involve an emotional appreciation of the other, based notably on one's senses.

28 The author has shown in a previous study that anything exceeding a value of predator/Prey of 1.80 or any absolute value of predator or prey exceeding 4 likely leads to conflict, relationship stalling or rupture (Mesly, 2010).

29 In fact, countless examples confirm the use of an image of integrity and of false and incomplete information among financiers found guilty of massive fraud (e.g. Nick Leeson, Bernard Madoff). See Mesly, 2012.

30 For full referencing, see Mesly s and Mesly at al. previous writings (notably 2010, 2012a-b-c-d).

References

1. Anderson, J. C. and Narus, J. A. (1990). A model of distributor firm and manufacturer firm working partnerships. Journal of Marketing, 54(1), 42-58. [ Links ]

2. Baron, R. M. and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182. [ Links ]

3. Bowlby, J. (1973). Attachment and loss: Vol. 2. Separation: Anxiety and anger. New York: Basic Books. [ Links ]

4. Kempa, M. (2010). Combating white-collar crime in Canada: serving victim needs and market integrity. Journal of Financial Crime, 17(2), 251-264. [ Links ]

5. Mayer, R. C., Davis, J. H., and Schoorman, F. D. (1995). An Integrative Model of Organizational Trust. The Academy of Management Review, 20(3), 709-734. [ Links ]

6. Mesly, O. (2009). Les Équilibres dynamiques de prédation: une modélisation mathématique. Ottawa, Canada: Sprott Proceedings. [ Links ]

7. Mesly, O. (2010). Voyage au coeur de la prédation entre vendeurs et acheteurs. (Une recherche en utilisant la triangulation élargie ou percolation des données). Sherbrooke: Université de Sherbrooke. [ Links ]

8. Mesly, O. (2012). Comment les bandits à cravate s'y prennent-ils? Les bandits à cravate vus sous l'angle de la prédation. Montréal: Béliveau éditeur. [ Links ]

9. Mesly, O. (2012a). Discovering hidden truths in marketing phenomena: can the data percolation methodology help? Ciencia Ergo Sum, 19(1), p. 9. [ Links ]

10. Mesly, O., Racicot, F. É. (2012b). A note on financial predation: a marketing assessment. The Journal of Wealth Management, (Summer 2012), 1-3. [ Links ]

11. Mesly, O., Lévy Mangin, J. P., Racicot F. É. (2012c). A reliance on predatory behaviour in the context of economic negotiation as soon as given a chance? A three-group longitudinal study on the concept of perceived predation. Under review. [ Links ]

12. Mesly, O., Lévy Mangin, J. P., Racicot, F. É. (2012d). The emotional edge of financial predators - a four group longitudinal study. Soft Computing in Management and Business Economics. Barcelona: Springer. [ Links ]

13. Palmatier, R. W., Dant, R. P., Grewal, D. and Evans, K. R. (2006). Factors influencing the effectiveness of relationship marketing: A meta-analysis. Journal of Marketing, 70, 136-153. [ Links ]

![]() Correspondence:

Correspondence:

Olivier Mesly

Department of Administrative Sciences, 2nd floor.

101 Saint Jean Bosco Street.

Gatineau (Quebec, Canada). J8X 3X7

E-mail: olivier.mesly@uqo.ca

Article received: 11-04-2012

reviewed: 22-10-2012

accepted: 22-10-2012