INTRODUCTION

A growing body of research demonstrates the effectiveness of evidence-based pharmacy practice innovations.1,2 However, showing the effectiveness is not enough. Innovations in pharmacy practice need to be efficiently and effectively adopted, scaled, and sustained.3

Unfortunately, too many pharmacy practice innovations fail to survive past the initial implementation and study phase. Numerous potential reasons for this failure exist: mismatches between pharmacy business priorities and the interventions, insufficient support from stakeholders and customers, a poor match between the customer and the pharmacist’s value proposition, inadequate advocacy about the intervention’s benefits and value, and an unsustainable profit model. Available models of practice research have yet to show how pharmacists can consistently scale practice innovations in a sustainable way.

Numerous frameworks have been used to describe, understand, and predict the adoption and dissemination of evidence-based innovations into routine practice. This paper proposes a framework from the business literature, the resource-based theory of competitive advantage, which can be used for conducting research about innovations in pharmacy practice.

Originating from the strategic planning literature4, the resource-based theory of competitive advantage addresses the complexity of innovation adoption, diffusion, and sustained success in competitive practice settings.5 It is an interdisciplinary theory developed from wide ranging disciplines including marketing, management, ethics, law, supply chain management, and general business.6 Its deceptively simple premise is that the sustainability of innovations comes from developing superior capabilities and resources.4

It offers a theoretical foundation for evaluating innovations that can be used in the context of pharmacy practice.6 Pharmacy practice happens in competitive environments, so any theory should be consistent with a general theory of competition. As the name implies, the resource-based theory competitive advantage fits this requirement. Another argument for the theory is that it provides a foundation for standard theories of pharmacy practice research including implementation science7, pharmacoeconomics8, Donabedian’s structure-process-outcome framework9, operations research10, amongst others. This provides an opportunity to unite a number of research streams into a single coherent framework. In fact, the resource-based theory of competitive advantage can serve as a general theory for social and administrative sciences in pharmacy and pharmacy practice.

RESOURCE-BASED THEORY OF COMPETITIVE ADVANTAGE

The resource-based theory of competitive advantage argues that the long-term success of any business innovation (e.g., pharmacy service) is based upon the internal resources of the firm offering it, the firm’s capabilities in using those resources to develop a competitive advantage over competing options, and the innovation’s contribution to financial performance of the firm in a market.5 It is predictive because it hypothesizes directional relationships between the concepts of competition.

In this theory, the “firm” is defined as a business organization, such as an independent pharmacy, pharmacy chain, hospital, or other organizational entity that offers goods and services. In this paper, the term “firm” will be used interchangeably with the terms “business” and “organization.”

The theory considers innovating to be an evolutionary process founded on the following premises:6

Demand continually varies in market segments;

Consumers and firms lack perfect information;

Humans are motivated by self-interest;

Firms seek superior financial performance;

The firm’s heterogeneous resources are physical, human, and organizational capital;

Competition is the source of innovation and it comes from a firm’s ability to recognize, understand, create, select, implement, and modify strategies to its situation;

Financial performance between firms varies depending on their resources and capabilities.

Resource-based theory of competitive advantage argues that innovations achieve sustainable competitive advantage by accumulating and using resources to serve consumer interests in ways that are hard to substitute for or imitate. It states that successful innovations are determined not just by the innovation. Success is also the result of the people involved, the organization(s) behind the innovation, contextual factors surrounding its implementation and dissemination, and the innovation’s benefits to stakeholders and the firm. The theory has been studied extensively4-6,11, and it allows researchers to understand and explain what works, where it works, and why.

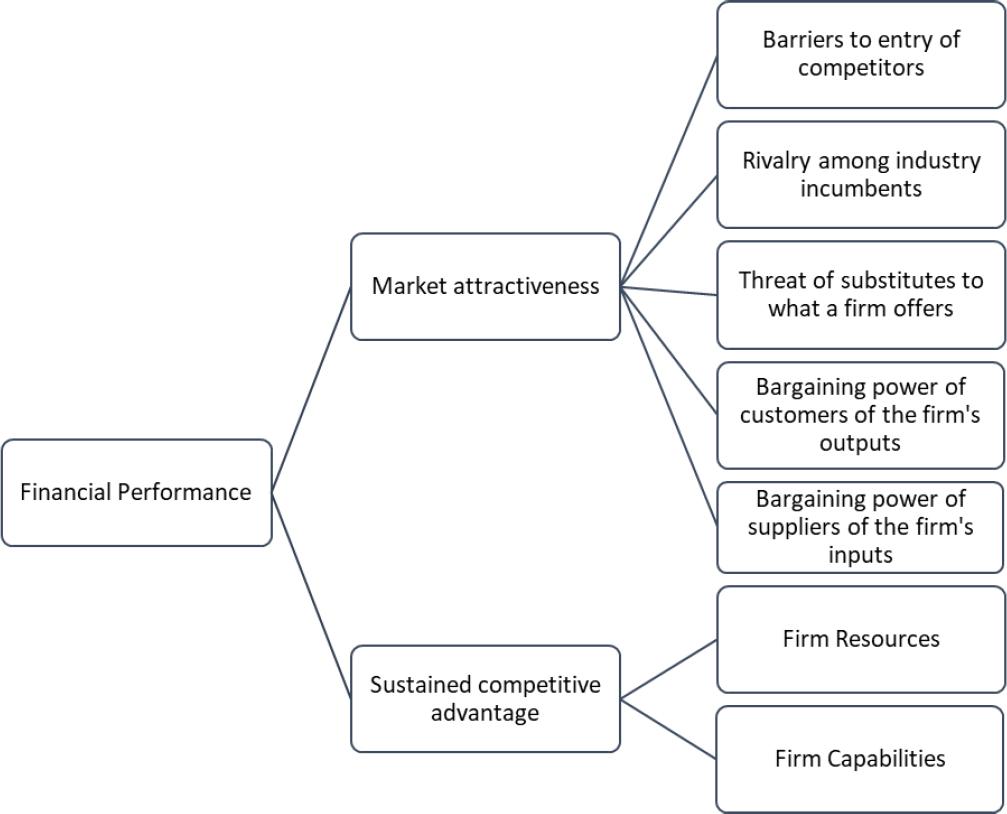

A resource-based model of pharmacy innovation is illustrated in Figure 1 and is based upon the work of several authors.4 5 6,11 In the framework, the sustainability of an innovation (e.g., a pharmacy service) depends on the innovation’s potential for adding to the firm’s competitive advantage and financial performance in the market environment in which the innovation is introduced. Furthermore, an innovation’s competitive advantage and financial performance depends on the dynamics of the marketplace and the firm’s ability to adapt the innovation to customer needs and wants better than competing options.

PHARMACY PRACTICE INNOVATIONS

Pharmacy Practice

For the purpose of this paper, pharmacy practice is defined as the provision of services by pharmacists and pharmacy organizations to respond to the medication-related needs of the people. Pharmacy practice has long been associated with the provision of tangible objects (i.e., drugs). However, practice really consists of intangible actions that facilitate the medication use process. They typically accompany a tangible drug, but the value provided by pharmacists lies not in tangible things but through intangible services.12

The definition above is broader than but consistent with the prescriptive vision of the Joint Commission for Pharmacy Practitioners, which sees pharmacist services as a way to help “patients achieve optimal health and medication outcomes with pharmacists as essential and accountable providers within patient‐centered, team-based healthcare”.13 It is more consistent with Moulin et al. for professional pharmacy services which are defined as “an action or set of actions undertaken in or organised by a pharmacy, delivered by a pharmacist or other health practitioner, who applies their specialised health knowledge personally or via an intermediary, with a patient/client, population or other health professional, to optimise the process of care, with the aim to improve health outcomes and the value of healthcare”.14 All three stress the importance of pharmacies and pharmacy organizations in providing professional expertise to achieve desired outcomes relating to medications.

The definition of pharmacy practice is made purposely broad in order to capture the wide range of activities that pharmacists provide to serve customers and stakeholders (e.g., other professionals, the firm’s C-suite). As long as the services involve 1) pharmacists or pharmacy organizations, 2) an attempt to respond to needs associated with medications, and 3) people including patients, the public, payers, stakeholders, and others, they can be classified as pharmacy practice.

Practice Innovations

Innovations in pharmacy practice consist of any changes in the provision of pharmacy services that are perceived as new by consumers, payers, or stakeholders. Practice innovations can be in the services themselves, the service process, or the service business model (Table 1).15

Table 1. Categories and examples of pharmacy practice innovations

| Category | Examples |

|---|---|

| New services or service bundles | • Offering something new (e.g., specialty pharmacy services) • Finding new customers (e.g., offering veterinary pharmacy services to customers with pets) • Expanding a product line (e.g., adding immunizations to basic dispensing services) • Growing services (e.g., moving into new regional, national, or international markets) • Changing the service bundle (e.g., unbundling medication therapy management services into components), • Modifying existing service bundles (e.g., offering counseling in a private counseling area) • Repositioning an existing service bundle (e.g., promoting the pharmacist in advertisements instead of merchandise) |

| Service process innovations | • Improvements in the patient journey from the hospital to home through transitions in care programs • Pharmacy loyalty programs which reward patients for enrolling in medication adherence or medication therapy management programs • Use of practice guidelines and practice models • Retail clinics in pharmacies which permit one-stop health care for minor ailments • Smartphone apps which combine medication reminders, gamified health promotion, telepharmacy, and other services on one device • Use of artificial intelligence to personalize care to patients • Electronic point-of-care technology that offers discounts or some other form of value • Cashier-free stores which track items placed in carts by shoppers and automatically charge customers when they leave the store with those items • Shopping in pharmacies using augmented and virtual reality technology |

| Business model innovation | • Hospital Inpatient Value-Based Purchasing Program, which changes Medicare compensation to hospitals based on value-based purchasing measures relating to clinical processes, patient outcomes, measures of efficiency, and patient experience. • Federal 340B Drug Pricing Program, which allows eligible healthcare institutions to purchase outpatient drugs at significantly reduced prices from drug manufacturers. Savings can be used to expand service to Medicaid patients, the uninsured, and some other patients. • “Incident to” models in which pharmacists charge Medicare for clinical services provided under a physician’s National Provider Identifier (NPI) number. They are called “incident to” because they are provided alongside a physician evaluation or other service covered by Medicare. • Medicare Star Rating Program, which uses a star rating system to assess the performance of Medicare Advantage and prescription drug (Part D) plans. Compensation to plans is based on scores, which range from one to five stars. • Pay-for-performance contracts, which reward providers for meeting established performance measures for quality and efficiency. Alternatively, they may penalize providers who are associated with poor outcomes, medical errors, or increased costs. |

Service innovation

Innovations in services occur when services or service bundles are offered which are new to the market, firm, or industry.15 They can be radical innovations such as novel offerings (e.g., drone delivery) or entry into new markets (e.g., international expansion). Alternatively, service innovations can be incremental such as minor tweaks in the services offered, service improvements, or new promotional practices.

Service process innovation

Service process innovations are changes in service operations and processes that influence the consumer experience and outcomes.15 Process innovations may change the way information is exchanged between parties, improve back-office processes, or alter the structure in which services are provided. Because processes are so closely aligned with the services offered, they often result in new service or service bundles too. For example, appointment-based pharmacy services, in which enrolled patients have a designated monthly appointment day to pick up all chronic medications, are both a change in service process and a new service bundle.16 Like service innovations, service process innovations can be radical, consisting of fundamental changes to existing processes (e.g., appointment-based medication synchronization) or incremental, minor changes like altering pharmacy workflow. Whether radical or incremental, process innovations either change the customer experience (e.g., greater convenience), achieve new customer outcomes (e.g., improved medication adherence), or both.

Service business model innovation

Business model innovations are major changes in the way in which services generate revenues and/or earn profits.15 A service business model describes how service businesses (e.g., pharmacies) or their components (e.g., pharmacy department) generate sufficient revenues to cover the costs of providing services.17 In pharmacy, a business model innovation might be a move from the traditional practice of generating revenues by selling merchandise or providing services for a fee to new value-based, pay-for-performance, and other forms of business models.17

Business model innovations often lead to innovations in both service bundles and processes. Movement from fee-for-service to pay-for-performance pharmacy contracts, for example, has encouraged the bundling of unit dose packaging, smartphone apps, medication synchronization, and patient counseling to improve patients’ adherence to their medication regimens.

CONSTRUCTS AND THEIR RELATIONSHIPS

The key constructs and their relationships in resource-based theory of competitive advantage are described in Figure 2. Key constructs in the theory are: (1) firm resources and capabilities employed in generating competitive advantage in a potential market, (2) sustainable competitive advantage, (3) market attractiveness (or potential), and (4) financial performance.

Firm Resources

Barney states that resources are “all assets, capabilities, organizational processes, firm attributes, information, knowledge, etc. controlled by a firm that enable the firm to conceive of and implement strategies that improve its efficiency and effectiveness”.4 Resources can be:

Financial (e.g., cash, access to credit);

Physical (e.g., building, fixtures, equipment);

Legal (e.g., patents, trademarks);

Human (e.g., clinical, managerial, and interpersonal skills);

Organizational (e.g., culture, institutional knowledge, policies);

Informational (e.g., proprietary knowledge about operations and market);

Relational (e.g., relationships with suppliers and customers).

Resources can also be classified as tangible and intangible. Tangible resources are physical things like buildings, fixtures, land, machines, people, and technology. An intangible resource is any nonphysical thing that resides within a firm, including institutional knowledge, proprietary information, brand reputation, management expertise, financial assets, and organizational culture.

Firms that accumulate the right tangible and intangible resources can have a competitive advantage over other firms if those resources help them offer service innovations that are better and difficult to imitate or copy. In general, intangible resources offer more sustainable competitive advantages because they are difficult to copy. Tangible innovations like drive-through services, patient counseling areas, and touch-screen interactive kiosks offer an advantage for only a short time period because competitors can more easily duplicate or purchase them. Intangible factors like a pharmacist’s expertise in serving patients at the drive-through and counseling areas or the proprietary software embedded within the kiosk are more difficult to reproduce.

A broad range of resources associated with competitive advantage have been identified from the pharmacy literature (Table 2).18 19 20 21 22-23 Although the literature has examined a substantial number of resources supporting innovative pharmacy services, the studies are disconnected from any overall framework and have resulted in only a fragmentary understanding of their roles in competitive advantage.

Table 2. Resource types, capability category, and examples from the pharmacy literature

| Resource type | Examples from pharmacy literature |

| Financial | A business case for stakeholders, allocation of financial resources |

| Physical | Physical environment of pharmacy (e.g., adequate space/privacy and workflow), equipment and technology (e.g., computers); location |

| Legal | Prescriptive authority, collaborative practice agreements, provider status, credentialing |

| Human | Pharmacist competence, education and training for personnel, communication skills, motivation, leadership skills, professional satisfaction, pharmacist knowledge of and attitude toward cognitive services, pharmacists’ self-efficacy, autonomy, attitude of staff, sufficient staff |

| Organizational | Culture of pharmacy, innovative practice orientation, script volume, management support, reputation with the community |

| Informational | Access to patient records, access to reference literature, evidence of benefits of services |

| Relational | Relationships with physicians, pharmacist/patient relationship, support from professional organizations and/or government, external advisors or mentors |

| Capability Category | Examples from pharmacy literature |

| Managerial | Use of pharmacy technicians, delegation of tasks, organizational flexibility, human resources management |

| Marketing | Customer service, market segmentation, proactive entrepreneurial behaviors, services management, active relationship management with stakeholders |

| Financial | Cross-subsidization of expanded services, financial management |

| Technical | Being patient-centered, use of protocols, interaction with other pharmacists, use of a documentation system, learning from others, working in interprofessional teams |

Firm Capabilities

Capabilities describe the capacity of firms to use its resources to effectively meet customers’ / stakeholders’ needs. They can be divided into organizational and dynamic capabilities.24 Organizational capabilities are a firm’s ability to perform coordinated series of tasks using organizational resources to achieve a particular outcome. Dynamic capabilities are a firm’s capacity to harness physical, human, and organizational resources to adapt to and thrive in rapidly changing environments.

Organizational capabilities describe the ability to manage order, while dynamic capabilities describe a firm’s ability to respond to change. Kotter25 would call the former “management ability” and the latter “leadership ability.” Capabilities can be classified into basic managerial and leadership competencies of managerial, marketing, financial, and technical dimensions of business.

Prahalad and Hamel26 introduced the concept of core competence to describe a firm’s distinctive capabilities. They described core competencies as a congruent blend of resources and skills that distinguish a firm in a marketplace. To be competitive, core competencies need to:

Allow access to a broad variety of markets;

Make a significant contribution to the perceived customer benefits of the end product;

Be difficult to imitate by competitors.

Core pharmacy practice competencies of individuals and firms associated with competitive advantage have been described in the literature (Table 2).18,19,23,27,28 Firm resources and firm capabilities can be thought of as the strengths and weaknesses portion of a SWOT analysis that describes the things about a firm most likely to be a competitive advantage or weakness within a market.

Sustained Competitive Advantage

Resources and capabilities are the sources of competitive advantage in resource-based theory.4 Competitive advantage occurs when a firm uses its resources and capacities to offer something new and valued that differentiates itself from competitors.

Competitive advantage only results from determinant attributes — those that determine choice between competitors. An innovation that is perceived as having a clear benefit on determinant attributes offers a competitive advantage. For instance, personalized services offered by an independent pharmacy might give them a competitive advantage for customers who value customized treatment. Therefore, the goal of positioning is to identify determinant attributes about an innovation and highlight their advantages over the competition.

Competitive advantage is a function of a pharmacy practice innovation’s positioning relative to competitors. Positioning describes an innovation’s image in the mind of customers. Competitive advantage results from an image that is clear, distinct, and valued in the mind of customers. Positioning also refers to the attributes about an innovation (e.g., convenient, personalized) that distinguish it from competing options.

Competitive advantage must be sustained over time for financial benefits to occur. Sustainability means that the innovation offers an advantage that can be defended in a market for a significant period. This occurs when firms utilize resources and capabilities in ways that are difficult to imitate, as discussed above, and fend off competitors’ efforts to diminish their competitive advantage.6 Thus, competition is a constant struggle between firms to position themselves with a clear and unique value proposition. Firms with an advantage must continually innovate by investing in resources and developing competencies, as firms which have a broad range of distinctive competencies across different market segments may be able to outperform firms that have relatively few competencies.23 Accordingly, Prahalad and Hamel26 state that a portfolio of core competencies can be used to invent new markets, exploit emerging opportunities, and develop a sustainable competitive advantage. Overall, then, competitive advantage “has no end stage, only a never-ending process of change”.6

A variety of studies have examined competitive advantage in pharmacy practice. Some have focused on identifying determinant attributes of pharmacy patronage29,30 and patient preferences for pharmacy services.31,32 Others have looked at the sustainability of services33, science of implementation7,34, and distinctive competencies.23 Findings of the research indicate that competitive advantage in pharmacy practice is situational and specific to the markets in which practice occurs.

Market attractiveness

Market attractiveness describes the potential of a market to a firm’s success. “Market” refers to segments and not the total market because mass market innovations are rare in any industry. Therefore, competitive advantage needs to consider the potential of defined market segments for an innovation to succeed.

The ability to exploit market potential comes from a firm’s ability to use its internal and external competencies and resources to rapidly adapt to changing market environments.11 An innovation may succeed in one market segment but not another. The key is to match competitive advantage to the right segments.

A popular framework for assessing the attractiveness of a market is Porter’s five forces.35 In this framework, the intensity of competition in a market is determined by five industry forces: barriers to entry of competitors, rivalry among industry incumbents, the threat of substitutes to what a firm offers, the bargaining power of buyers of the firm’s outputs, and the bargaining power of suppliers of the firm’s inputs. An attractive market is one where a competitive advantage can be profitably developed and maintained. An unattractive market is one where competition for customers is fierce and costly.

Porter’s framework requires firms to understand the forces most relevant to their market segments. Therefore, the forces affecting the financial performance of a pharmacy innovation in one market can differ from the forces in another. However, there are some major forces affecting competition in most pharmacy markets.

Barriers to entry

Profitable markets attract new firms into the market. New competitors will increase supply and drive down prices, thereby decreasing the profitability of all firms in the industry. Barriers to market entry determine the ease to which these new competitors can enter into a market.

A broad number of barriers exist in pharmacy markets. Pharmacy practice is subject to oversight by an array of local, state, and federal agencies, making it one of the most regulated professions. Any entrant into the market must jump through a large number of regulatory hurdles. Barriers also exist due to economies of scale available to large pharmacy chains which make up a major part of the prescription drug market. Access to those health insurance markets is biased toward larger firms who can provide wide geographic coverage to covered patients. In addition, these larger firms can more easily accept low profit margins on the sales of prescription drugs, thereby making the market less desirable to new entrants. Switching costs are another barrier due to the influence of pharmacy benefit managers (PBMs) which act as intermediaries between pharmacies and healthcare insurers. PBMs push pharmacies to participate in limited networks that give network pharmacies exclusive access to insured patients. Pharmacies outside of the network are blocked from receiving compensation for insured patients, while pharmacies inside of the network must accept stringent terms of service and undergo controversial auditing procedures. Switching costs of leaving those networks are high because switching shuts pharmacies out of substantial markets of insured individuals.

Nevertheless, pharmacies with unique value propositions can still enter the market. For example, the online pharmacy PillPack, recently purchased by Amazon.com for approximately USD1 billion, carved out a place in the market by offering a consumer-friendly full-service pharmacy that fills prescriptions and ships drugs packaged in pre-sorted doses to make it easier to manage multiple medications.

Industry rivalry

The intensity of competition is high in the US, with 89% of Americans living within 5 miles of a pharmacy.36 In some locations, two or three community pharmacies may be located at a single road intersection. Prescription drugs can be purchased at independent or chain pharmacies, grocery stores, large discount stores, pharmacy benefit managers and many other outlets. Omnichannel retail strategies make it possible for patients to purchase prescription drugs 24/7, 365 days a week using online, smartphone apps, drive-through, drone delivery, and even face-to-face interactions with a pharmacist.

Although the rivalry for selling drugs is intense, opportunities still exist for pharmacy innovations. There are many geographic locations that are far from a pharmacy or contain populations underserved by pharmacy services.37 Another opportunity is for pharmacists to move from dispensing responsibilities to roles in primary care38, as is seen in new business models like the pharmacy hub. In the hub model, the neighborhood pharmacy is a source of “primary care, prescriptions, point-of-care diagnostics, insurance, financing and insight into how to be well and stay well”.38,39

Threat of substitutes

A substitute for a service bundle is one that is distinctly different but nevertheless meets similar customer needs and wants. Substitutes for pharmacists in dispensing activities are pharmacy technicians and technology such as robots. Substitutes for pharmacist services in primary care include physicians, nurses, nurse practitioners, physicians’ assistants, and other health care professionals. Each offers a unique primary care approach that meets similar patient needs.

The threat of primary care substitutes is real and requires pharmacists to leverage their resources and capabilities to compete. One obvious advantage is the accessibility of pharmacists in the community. Each visit to a pharmacy is an opportunity to develop a therapeutic relationship with a patient. Another advantage is a pharmacist’s’ expertise with medications and drug-related problems. This can be used in innovations in improving medication adherence, vaccinations and health promotion, non-prescription medication use, and more. Pharmacists must market themselves effectively to tap into these opportunities.40

Bargaining power of buyers

The buyers’ bargaining power describes their sensitivity to price changes in what is being offered. When buyers have bargaining power, they can put pharmacies under pressure to accept lower prices for their output.41 In the US pharmacy market, buyers of pharmacist services have significant power over sellers. One of the major buyers of pharmacist services is the PBM industry, where approximately 70-75 percent of all prescription claims are handled by the three companies: Express Scripts, CVS Caremark, and OptumRx.42 Another major buyer with significant power is the US government, which is forcing pharmacies to innovate under pay-for-performance and value-based purchasing plans. Large pharmacy chains have attempted to adapt through consolidation (pharmacies purchasing other pharmacies) and vertical integration43 (pharmacies merging with healthcare insurers and wholesalers).

One hope for pharmacists is that the Federal Government will recognize pharmacists as providers and set higher expectations for the scope and quality of pharmacy services. Buyers in the private market typically follow Federal practices, so the government can drive pharmacies to engage in more primary care services. Rather than relying on hope, pharmacists are attempting to work within the business models established by various payers.17

Bargaining power of suppliers

The bargaining power of suppliers describes the degree to which suppliers can put firms under pressure to pay more for inputs. Suppliers to pharmacy service providers can be drug manufacturers, wholesalers, labor, services, or other inputs. Supplier bargaining power is usually a function of the number of suppliers of inputs or the availability of supplier substitutes. In extreme cases of supplier power, firms have few alternatives to accepting whatever terms suppliers demand.

In pharmacy practice, the major suppliers are pharmaceutical companies and the pharmacist labor pool. Pharmaceutical companies have significant ability to set the price for their single source drugs but less so with multisource medications. The pharmacist labor pool has lost significant bargaining power with employers because of the oversupply of pharmacists in some markets. Anecdotal reports suggest that the lower cost of pharmacist labor resulting from oversupply may lower the cost of labor-intensive pharmacist innovations.

Financial performance

Financial performance is the ability of a firm to earn excess financial benefits from an innovation in a defined market. Financial performance in the resource-based theory typically refers to profits, which generally describes what is left from the revenue generated by a firm after it pays for the expenses for resources and capabilities used in generating that revenue. However, it can also describe other measures of financial performance such as return-on-investment (ROI), cost-benefit, and budget impact. In many cases, these measures of financial performance will be more appropriate for describing the impact of pharmacy practice innovations.

Financial performance is determined by a firm’s competitive advantage over rivals and the attractiveness of the market in which it competes.5 Therefore, profitability of a service innovation lies both in its ability to develop a competitive advantage and to identify a potential market where the benefits to the innovating firm or organization exceed the costs of providing the innovation over time. An innovation that is not supported by market conditions cannot be financially viable and sustain itself.

The pharmacy literature has attempted to measure the financial performance of pharmacies and innovations in a variety of studies. A study of competition in the German pharmacy market44 found significant relationships between economic success (measured by net revenue development and sales profitability) and both resources (i.e., staff number) and capabilities (i.e., active customer oriented-management, aggressive attitude to competitors). Market attractiveness was not found to be associated with financial performance because competitive pressures were not considered by respondents to be a major concern in strategic decision making. A study of individual service innovations at a single pharmacy examined financial performance using net profitability.45 The authors found that most of their 11 services showed an annual positive net gain. Business cases for pharmacist services have emphasized ROI to measure financial performance.22 Cost benefit and other economic analyses have also been used to assess pharmacy practice innovations.46,47

In resource-based theory, firm profitability is the end goal for any business activities. Other measures of financial performance like ROI, cost benefit, and budget impact are intermediaries to profitability. Therefore, the sustainability of pharmacy practice innovations relies heavily on the business case made for its contribution to the firm’s financial well-being.

USING RESOURCE-BASED THEORY TO INFORM PHARMACY PRACTICE RESEARCH

A significant body of research about pharmacy practice innovations has been developed over the years using a variety of conceptual frameworks, theories, and models of implementation.48 Other studies have offered no explicit theoretical rationale for evaluating their practice interventions.

The variety of approaches to innovation research has fragmented the literature and given vague guidance to practitioners and researchers about how to develop successful pharmacy practice innovations. Variations in theories and frameworks have led to different terminology and classifications for innovation concepts. Without a common nomenclature and framework, pieces of the puzzle about the value of pharmacy interventions can be missed or never examined.

Resource-based theory of competitive advantage offers a way of harmonizing innovation research. As a theory, it both explains the relationships between concepts and offers hypotheses on the directional relationships of variables. It is highly applicable to practice because it addresses innovations within the real-life context of competition in the healthcare marketplace. Furthermore, it provides a foundation for comparing research findings from different research frameworks.

Table 3 compares major concepts in resource-based theory with those of other evaluation frameworks with disciplines that are common to pharmacy practice. The most common frameworks and disciplines are Donabedian’s structure-process-outcome quality measurement; operations research; implementation science; and pharmacoeconomics. They each propose independent variables, dependent variables, and covariates relating to pharmacy practice. Like resource-based theory, they all see innovations in a context (e.g., attractiveness of market) of inputs (e.g., resources), transformation processes (e.g., competencies), and outcomes, both intermediate (e.g., sustained competitive advantage) and final (e.g., financial performance). Understanding commonalities in frameworks and discplines allows researchers to compare findings across distinct research streams.

Table 3. Comparing frameworks/disciplines for evaluating pharmacy practice innovations

| Research Framework | Resource-based Theory5 | Donabedian9 | Operations Research10 | Implementation Science48 | Pharmacoeconomics8 |

|---|---|---|---|---|---|

| Independent Variables | Resources | Structures | Inputs | Factors | Medications |

| Competencies | Processes | Transformation Processes | Factors | Value-added services | |

| Dependent Variables | Sustained Competitive Advantage | Intermediate outcomes | Outputs | Strategies | Intermediaries |

| Financial Performance | Health outcomes | Outputs | Evaluations | Economic, clinical, humanistic outcomes | |

| Covariates | Attractiveness of Market | Patient clinical, demographic, & preference factors | System | Context of implementation | Perspective of analysis |

The resource-based theory of competitive advantage provides a framework for posing a number of research questions about pharmacy practice innovations. They include the following:

RQ1. How does the pharmacy practice literature explain the competitive advantages of professional services?

RQ2. What pharmacy practice resources are associated with competitive advantage?

RQ3. What competencies of pharmacy practice are associated with competitive advantage?

RQ4: How would pharmacists’ competitive advantage change if they had access to new resources (e.g., full patient data)?

RQ5: How would pharmacists’ competitive advantage change with different competencies (e.g., entrepreneurial processes)?

RQ6: Under what conditions of the pharmacy market does competitive advantage lead to financial performance of firms?

RQ 7: What advances in market segmentation can be used to exploit the competitive advantages of pharmacy practice innovations?

RQ8: What competencies of individual pharmacists are needed to maximize their contribution to the competitive advantage of firms?

RQ9: What characteristics of markets (i.e., Porter’s five factors) positively influence innovations in pharmacy practice?

RQ10: What constructs and dimensions define innovative pharmacy services and their contributions to competitive advantage?

RQ11: What proportion of published pharmacy practice innovations are sustained 2 years past the initial implementation and study phase?

RQ12: What resources and competencies are associated with financial performance of pharmacies?

CONCLUSIONS

Competition is a fundamental aspect of business and innovation. Innovations in pharmacy practice occur in competitive markets in response to opportunities and threats to pharmacy firms. The types of innovations are determined by the strengths and weaknesses of pharmacies offering them. Pharmacy innovations can only sustain themselves with positive financial performance.

External forces in the healthcare market are causing greater urgency for pharmacists to change their models of practice. Pharmacists and pharmacies have known for a long time that a product focus was not a viable future for the profession. It is only in recent years, however, that product-centered business models have become increasingly unprofitable. The status quo in pharmacy practice is not sustainable, but it is also not clear what practice models can succeed.

Resource-based theory of competitive advantage provides a way of explaining how pharmacy practice innovations can be sustained in various markets. It is relevant and useful to pharmacy practice research because it addresses the issue of competition in healthcare marketplace. It also offers a way of comparing research findings from different research frameworks. A case is made in this paper that the resource-based theory of competitive advantage can serve as a general theory for research in pharmacy practice and in the social and administrative sciences.

This paper shows how the findings of past research in pharmacy practice innovations can be applied to resource-based theory. It also suggests ways to tie those findings together into a more cohesive plan for future research that can guide practitioners and researchers about how to develop successful pharmacy practice innovations.